E-invoicing regulations and (near) real-time reporting are becoming the global norm. The digital revolution has prompted the imposition of e-invoicing mandates by governments in their attempts to curtail tax evasion and optimize compliance. Where some regions and countries have already legislated e-invoicing, some are still in the introduction phase.

Indirect Tax teams from businesses that are in a transition or transformation project due to the upgrade of their ERP system or introduction of an Indirect Tax engine are occupied by scoping the internal processes and setting up the system requirements for Indirect Tax determination and Indirect Tax reporting. On top of that, for the regions where e-invoicing is already mandated, the Indirect Tax team needs to 1) familiarize itself with the invoicing process of the workstream Order to Cash, 2) understand the E-invoice solutions available on the respective marketplace, 3) understand the IT-infrastructure between the source system and the e-invoice solution and 4) make sure the data is structured correctly so that the e-invoice platform is able to create the e-invoice.

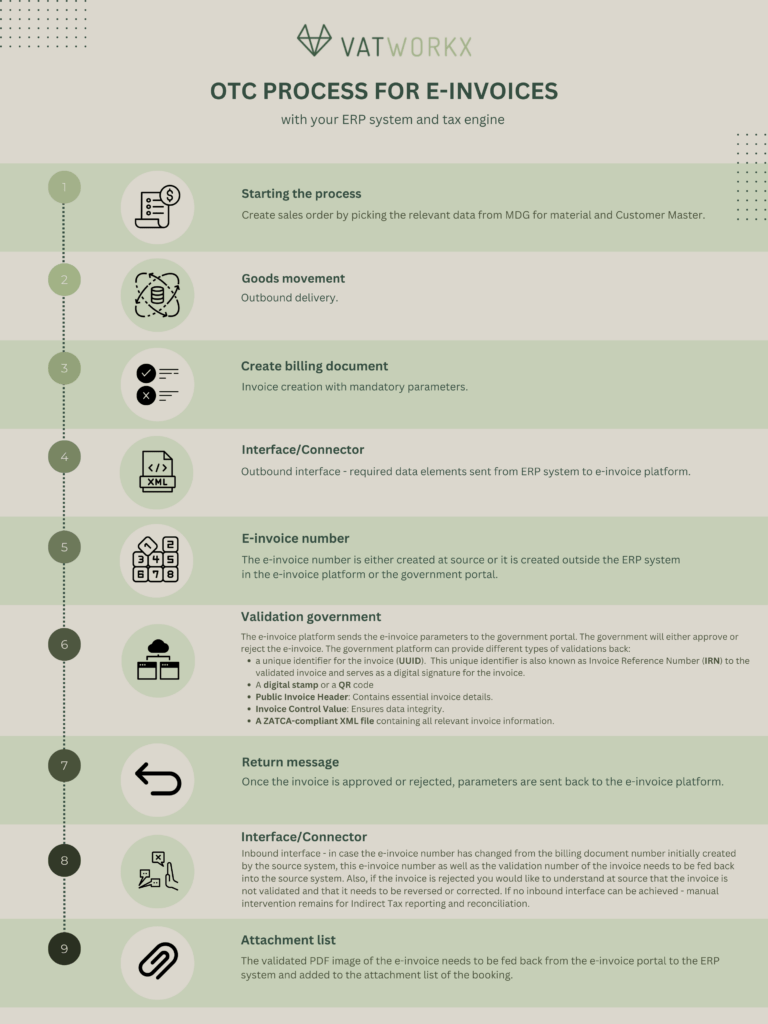

Even though global e-invoice processes may vary between jurisdictions, we will provide some key takeaways for your transition and transformation efforts, based on the process in some LATAM countries.

E-invoicing process governed by the workstream Order to Cash

As mentioned in our earlier articles, it is important to keep in mind that Indirect Tax is not an independent workstream. Regarding e-invoicing within a transition or transformation project, it is key that the Indirect Tax team is included in discussions of the colleagues from the Order to Cash team with e-invoice solution providers. The Indirect Tax team needs to set up the Indirect Tax process and data requirements for the Order to Cash team, so that the latter can make sure these requirements will be configured. Incomplete or incorrect configuration of the process and mandatory parameters will result in incomplete and incorrect Indirect Tax determination and reporting.

An example of an e-invoice process can be shown as follows:

Data elements at source

As mentioned, it is important to understand which data elements are mandatory fields for creating an e-invoice. A lot of parameters are Master Data related and pertain to the following master data objects:

E-invoice number

The first question is where is the e-invoice number created? Is it created in the ERP system, thus at source or is it created in the e-invoice platform? For LATAM markets, where the e-invoice number is already created in the ERP system and therefore not changed by processing the invoice through the 3rd party portal or by validating the e-invoice by the government, the process is quite convenient. The e-invoice number remains the same in the End-to-end process and can be easily tracked for reconciliation and reporting purposes. This is achieved by converting the billing document number to a reference number in the source system. Make sure that at the start of the project, the reference number field can reflect sufficient digits. Most of the time the standard set-up of the reference number field is insufficient for the number of digits required for the e-invoice number. Therefore, changing the standard set-up of this reference field is highly recommended at the start of your transformation project when the aim is to automate as much as possible.

For countries where the e-invoice number is created outside of the source system – in the e-invoice platform or government portal- it is key to request to interface the e-invoice number back into the source system. When considering interfaces most of the time the outbound interface can be set up; more challenges are with the inbound interface. Consequently, in these “outside the system” situations local teams are left with no other option than to manually manipulate the data and join the data from the different sources (billing documents from the ERP system, extract from the e-invoice platform and validation details from the government platform).

PDF image of legal invoice (approved e-invoice)

The legal invoice is not the invoice created as a billing document in the first step of the e-billing process. The legal invoice is the e-invoice that is approved by the government. The PDF images of the validated e-invoices will be stored in the e-invoice platform and will not be automatically attached to the attachment list of the booking in the ERP system. Preferably an inbound interface is set up so that the

legal e-invoices can be made available at source. If not it is recommended to request local business support teams to manually include the e-invoice to the ERP system. From an indirect tax perspective, all key data elements are available in the source system and ready for Indirect Tax audits.

The key takeaway is that the Indirect Tax team understands what parameters/fields are mandatory and in what format they need to be made available for every jurisdiction where the business operates. Simultaneously, understanding the flow of these mandatory parameters and where these fields can be found in the source system, are equally important as when issues arise the team is able to perform a root cause analysis and fix the blocker.